Actually Asked Questions

Is there a simple explanation of how CDM works?

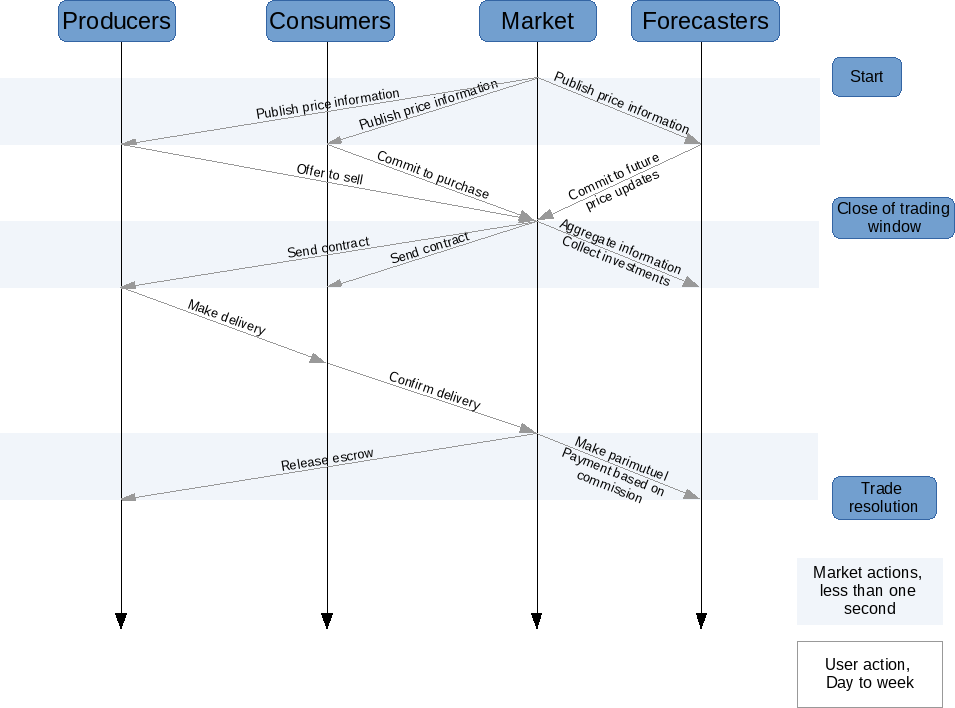

This is currently the simplest description of the system:

What is a parimutuel pool?

A parimutuel pool is a system where bets are collected and then rewards are paid out from that collection. In a standard parimutuel system the operator will take a cut of the pool before division. In CDM the operator augments the pool with a share of the commission income making the reward pool comprise the investments plus the dividends of trade enabled by the forecasting.

How much do I earn from a speculation?

That depends on its accuracy. The correct portion of your speculation earns a pro-rata share of the parimutuel pool augmented by the trading commission associated with your speculation.

How can I always get a 100% annualized return?

Always be right.

Okay I meant to ask how can you offer 100% annualized return?

By computing price that way. Return is a ratio of payoff and investment. Since projected payoff is known at speculation time, we can divide by any return rate we like to calculate investment price. In other words, CDM will charge speculators enough to pay winners. The actual value (in terms of price information) of your prediction can be calculated, and you must pay a calculated amount to speculate. Cost of speculation, and the related return on investment is a formula. If every speculator chooses the same price, only one of them will win the randomized speculation settlement. Speculators who choose incorrect prices will lose in proportion to how much they turn out to be wrong, and their loss goes into the speculation parimutuel pool. The 100% annualized return is from an equation paid for by up front cost to speculate. Money doesn’t magically appear from nowhere.

What happens if my speculation turns out to be wrong?

The erroneous portion of speculations is in the parimutuel pool to provide return for those whose speculations corrected errors. Your bad speculation is essentially divided up among the correct speculators.

What happens if I can’t pay for my speculation?

If your investment commitment is insufficient to fully integrate your speculation then the system will integrate as much as the money you have provided will allow. You pay when you speculate, not later. You can only move the price as much as you can afford to right now.

What keeps me from hiding information from the system so I can get a better price?

Nothing other than self interest. Bad prices come with lower clearance rates. Your best profit is at the highest clearance rate. Additionally, if you don’t speculate on price information, you leave an opening for another speculator to profit once the knowledge you have becomes public, as it eventually will at the time of trading if not sooner.

Can’t I simply buy a commodity and speculate a higher price in order to game the system into giving me money?

No. The system doesn’t guarantee counter parties so you won’t be able to sell at inflated prices as no one is compelled to take that deal. Also, bidding a price wrong against the entire marketplace is quite expensive. The most probable outcome is that the marketplace swallows your attempt and you lose the money. If you are very unlucky and put up an enormous amount of money then you will lose most of that money and then be successfully prosecuted for market manipulation, as well as being civilly liable for trade disruption.

How much does it cost to change the price for the next trading window?

As stated above, price is computed by dividing projected reward by return. In the short term return rates are low so costs are nearly the size of returns. Looking at it another way, it is very unlikely that you can improve the already very accurate prices in the very near future, and CDM pays for improving prices.

How far into the future should I predict prices?

Be guided by yourself. Longer terms lock up investments longer but the higher returns make errors less costly. In all cases, you make money by accurately predicting price. You make less for imperfect predictions, but profit none the less, so speculate as far into the future as you feel will give you a reward.

How many speculations should I make?

Again be guided by yourself. If there are times and products you don’t feel you have useful information about then skip those.

In a CDM with a weekly trading window, there are roughly 250 possible speculations for the next 5 years. How do I decide where to apportion my speculation budget?

Self-interest. Do what you think will make you the most money. The CDM_data spreadsheet offers some simple computations to give some ideas.

What happens if I change my mind about a speculation before the speculation window closes?

Then update your account. Speculations are private, and can be updated until the window closes.

Isn’t there some advantage in waiting until the last millisecond of the speculating window in order to have the most information?

Sure. However the system only responds to the messages it receives during the hours of its operation. The CDM marketplace doesn’t have the timing demands of existing designs. If your speculation is lost because you entered it after closing, then you can enter it for the next window, assuming it is still relevant. Note that near-future speculations have little value to CDM and therefore little profit for you.

Big traders with giant super computers can trade faster, so won’t they have an advantage in CDM?

Everyone trades at the same speed and bigness is systematically disadvantaged as the marketplace wants to encourage competition. Being big and successful in CDM requires you to be better than average to make up for being big. Keep in mind that the amount of money an individual speculator floats on speculations in CDM is a tiny fraction of what is necessary to spend in a futures-based system. CDM rewards speculators with good price information, and only pays what the information is worth.

How will CDM stop HFTs from randomly changing prices for their own gain?

HFTs arbitrage small briefly extant asymmetries in price information. This is theoretically valuable since transaction risk would be reduced by impounding more information in the current price. CDM reduces transaction risk by batching transactions and flattening the risk across all trades. The efficacy of HFT in improving marketplace dynamics is contested.

Big consumers/producers will out weight everyone else in determining the ideal price on the supply and demand curve.

Actually the supply and demand curves are determined by the marginal traders. If large companies are operating at the margin, the bottom up settlement system will drive them out of business. The only successful way to be a large player in CDM is to be better than average.

CDM won’t stop people from mortgaging their house and losing everything on a bad speculation.

True, idiots do dumb stuff. However CDM eliminates all systemic risk associated with credit expansion of the speculative market and limits all downside risk to the amount committed at the time of the investment.

If current market makers don’t participate, CDM won’t have enough information to determine the ideal market price for each trading window.

As long as a competitive marketplace exists it will publish the information required to operate a CDM. Once the customers switch for CDM’s better prices, holdouts can join or starve.

Speculators with access to Big Data will constantly tweak the price, squeezing out all other speculators.

Sounds great. Producers and Consumers can enjoy their perfect prices at lower cost without any hassle of having to use the forecasting market. In CDM it doesn’t matter who forecasts prices, only their performance, and the benefits of success are reaped by the traders. It is worth noting that the speculation pool is settled in random order. If the price needs to move five cents and 20 speculators (including giant institutions) know that, only one of those 20 will “win” the price move. Any speculators who’s speculation is not used receive a refund.

Speculators with deep pockets will make thousands of speculations in every speculating window, and small speculators won’t stand a chance.

Since acting that way wouldn’t add to the information of the market, that would be guaranteed to lose money as a strategy. Their assured wins wouldn’t make up for their greater assured losses. The net result of trying to manipulate the market is going into the red. Remember, speculation settlement is a lottery, and CDM only pays for information. Once a price has been moved, you can’t move it unless some other speculator moves the price in the opposite direction. Settlement being random, and CDM lacking counter-parties, there’s simply no way to game the system without enriching the other participants.

Large speculators could take every reasonable position.

See above. That loses money.

CDM won’t stop someone with lots of money from cornering the markets.

But it does assure that cornering the markets is a money loser. The only way to accumulate trade goods is to raise prices first. This means that the money you expect to be able to make from cornering you first have to spend.

What prevents CDM from being used to launder money?

Counter parties are untargetable so the process of hiding the parties to a transaction from external scrutiny doesn’t work because you can’t create even an unreliable channel.

Government price subsidies and guarantees will effect supply/demand, so that CDM can’t find the ideal price.

Seeking the ideal price isn’t the goal, rather finding the actual price is what matters. Governments which wish to interfere to the detriment of their economies will distort pricing in the same way in CDM as with any other effective price mechanism.

A massive crop failure will prove everyone wrong, and all the speculators will lose their speculations.

Global scale disruption if unanticipated will result in global loss. However since there is no leverage there will be no contagion so recovery is immediate. The first speculators to adjust price after the catastrophe will profit by adjusting all future prices. The market has a new price equilibrium. We think the price/supply/demand bounce will be one or two trading windows, with some gradual price changes as participants adjust to the new reality.

Hackers will break into CDM, and manipulate speculation and trade clearing without being detected.

Since trust is a key selling point for a CDM the design allows for conducting market operations in a fashion which allows easy auditability to be an essential feature. This means that such activities can be easily detected and well understood open solutions can be deployed against them.

The market maker’s order book is properly a secret, necessary to the function of markets. CDM can’t function because the speculators’ book is no longer secret.

That is one of the limitations of existing marketplace design that CDM avoids, making for an improved system. By separating trade from speculation it is unnecessary to collect, and secure, intentions to trade as part of price discovery. Instead, an environment allowing the coordination of large numbers of traders to openly arrive at generally optimal conditions is created. The “coordinated discovery” of Coordinated Discovery Markets is the discovery of the ideal price by coordinating information from a large number of participants.

CDM can’t function without liquidity provided by market makers.

That is one of the limitations of existing marketplace design that CDM avoids making for an improved system. CDM liquidity is in the form of actual delivery. In conjunction with CDM’s ability to support many simultaneous buyers and sellers this allows even small end-users to internalize the costs they would normally incur hedging against market risk. This means that CDMs can systematically underbid competitive futures-based marketplaces.

We see commodity prices changing on a millisecond basis in the current system, but CDM will use longer windows, and must be losing critical price information.

Current futures markets can trade on microsecond scale (1000x faster than milliseconds). But price information is only relevant to decision making about trades. Trades happen in a physical universe which take time for delivery. Existing markets are actually producing excessive noise.

CDM can’t respond within second, or even hours to massive price swings caused by catastrophic events, but the current system responds almost instantly.

Global scale disruption if unanticipated will result in global loss. However since there is no leverage there will be no contagion so CDM’s recovery is immediate. CDM’s response to catastrophic events is an orderly return to a new equilibrium price.

CDM speculators will act like sheep, constantly changing prices based on whims and psychological factors unrelated to supply and demand.

Since the price is an aggregate value, herd behavior, if it exhibits, is fine. However, sheep that guess the price wrong will lose money. Fairly quickly, only wise, non-panicky, very smart sheep will be speculating in CDM.

By allowing producers and consumers to speculate, CDM is inviting price collusion.

Price collusion between the two sides of the trade which everyone can freely participate in? That is the definition of a competitive market.

Producers and consumers have less information about price than educated market makers.

Then these educated market makers can earn very high returns speculating in a CDM.

Producer and consumer hedging strategies are very complex under CDM. Farmer’s won’t be able to cope.

The best hedging strategy as a producer/consumer is simply to bid your marginal cost/value.

Many CDMs will exist for each commodity, and everyone will be confused.

Marketplaces are natural monopolies. This will be no worse than existing arrays of markets.

Under CDM prices will be so fixed that we will essentially function like a communist planned economy, resulting in a total collapse of our economy.

Known prices not fixed prices. Known, predictable, reliable prices lead to better planning and dramatic gains in efficiency throughout entire supply chains. When CDM is boring, everyone is happy.

Constant, known, predictable prices are bad for productivity.

But trustworthy known prices such as those produced by CDM are great for productivity.

Why is eliminating futures trading is a preferable outcome since producers and consumers alike benefit from the hedging and speculating functions given the dynamic nature of the growing season?

They do benefit from hedging and speculation now, this market structure provides them that same benefit at a lower cost.

An exchange like the CME isn’t at all necessary if transactions become real-time cash market transactions, is that correct?

Yes it is, strong logical arguments show that systems like this will work and that once started exchanges like the CME will die away as those that seek higher returns leave.

Isn’t this is already being brokered off-market OTC?

Existing OTC and clearing house solutions have no price discovery mechanism requiring them to have a benchmarking exchange or suffer the usual problems of illiquidity. By having an effective price discovery mechanism this can operate as a marketplace.

In an OTC world, how would anonymity be maintained, as this is a concern for big buyers and sellers (as well as speculators)?

A CDM doesn’t need to publish any more identifying information than a futures market does. Obviously from a KYC perspective you do have to tell the CDM who you are but that is pretty standard. Also the primary legitimate reason to hide your transaction identity, the desire not to expose yourself to market risk changing your order price, doesn’t apply to CDM.

Have a question you’d like answered? Send in your question with the form below.